Executive Summary

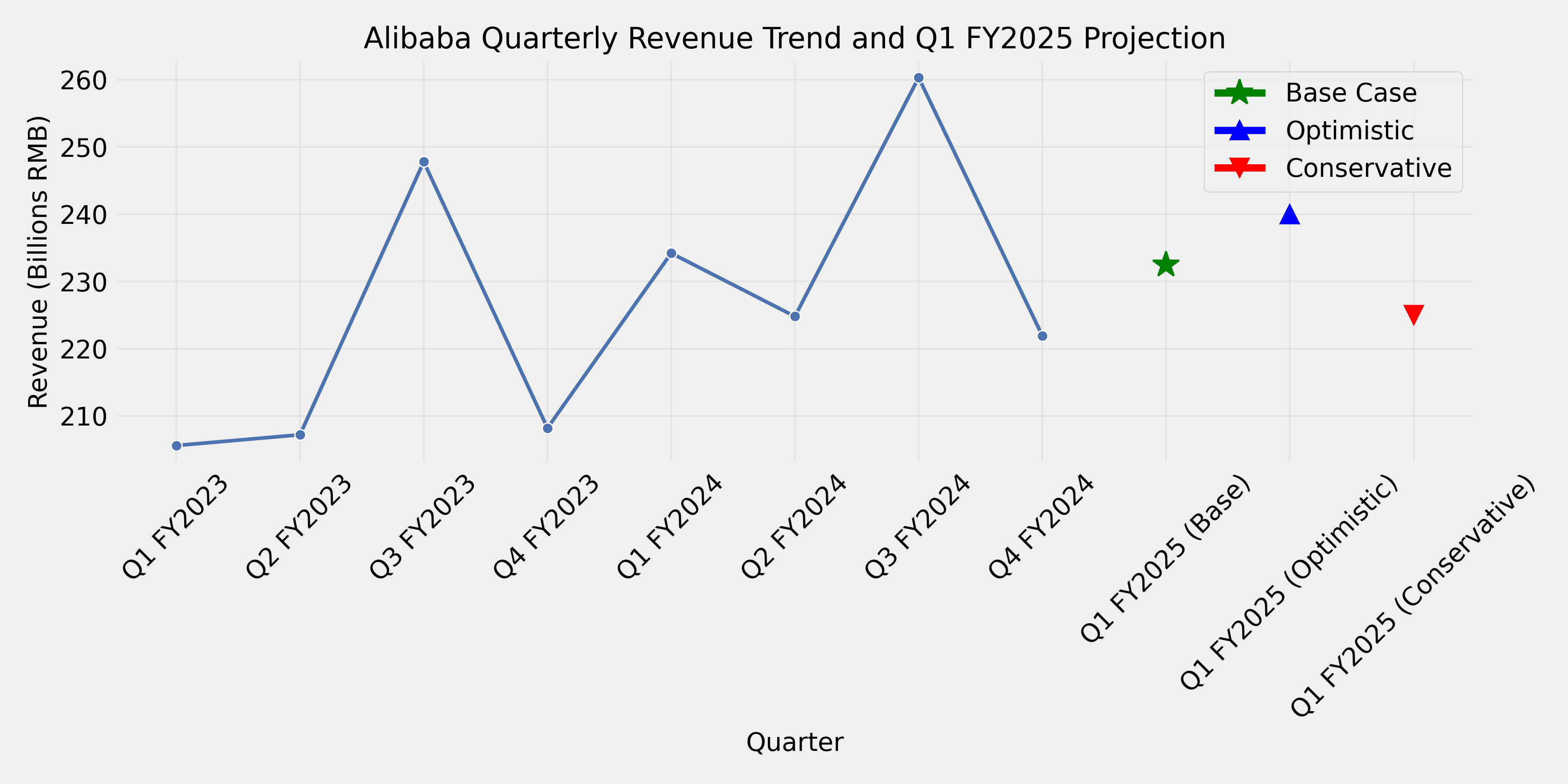

Alibaba Group Holding Limited (NYSE: BABA) reported its fourth-quarter fiscal 2024 results on May 14, 2024, delivering mixed performance that fell short of market expectations. While the company reported revenue growth of 7% year-over-year, reaching RMB 221.87 billion (US$30.73 billion), several key metrics disappointed investors, leading to a negative stock price reaction.

Fig 1: Alibaba's quarterly revenue trend with Q1 FY2025 projections under different scenarios

This analysis examines why Alibaba's results failed to meet market expectations and provides projections for the next three months based on current trends, management guidance, and market conditions.

Key Financial Metrics vs. Expectations

Revenue

Non-GAAP EPS

Net Income

Free Cash Flow

Why the Results Disappointed Investors

- Dramatic Decline in Net Income: The 96% year-over-year decline in net income to just RMB 919 million (US$127 million) was alarming to investors. While this was primarily attributed to mark-to-market losses from investments in publicly traded companies, the magnitude of the decline raised concerns about Alibaba's investment strategy.

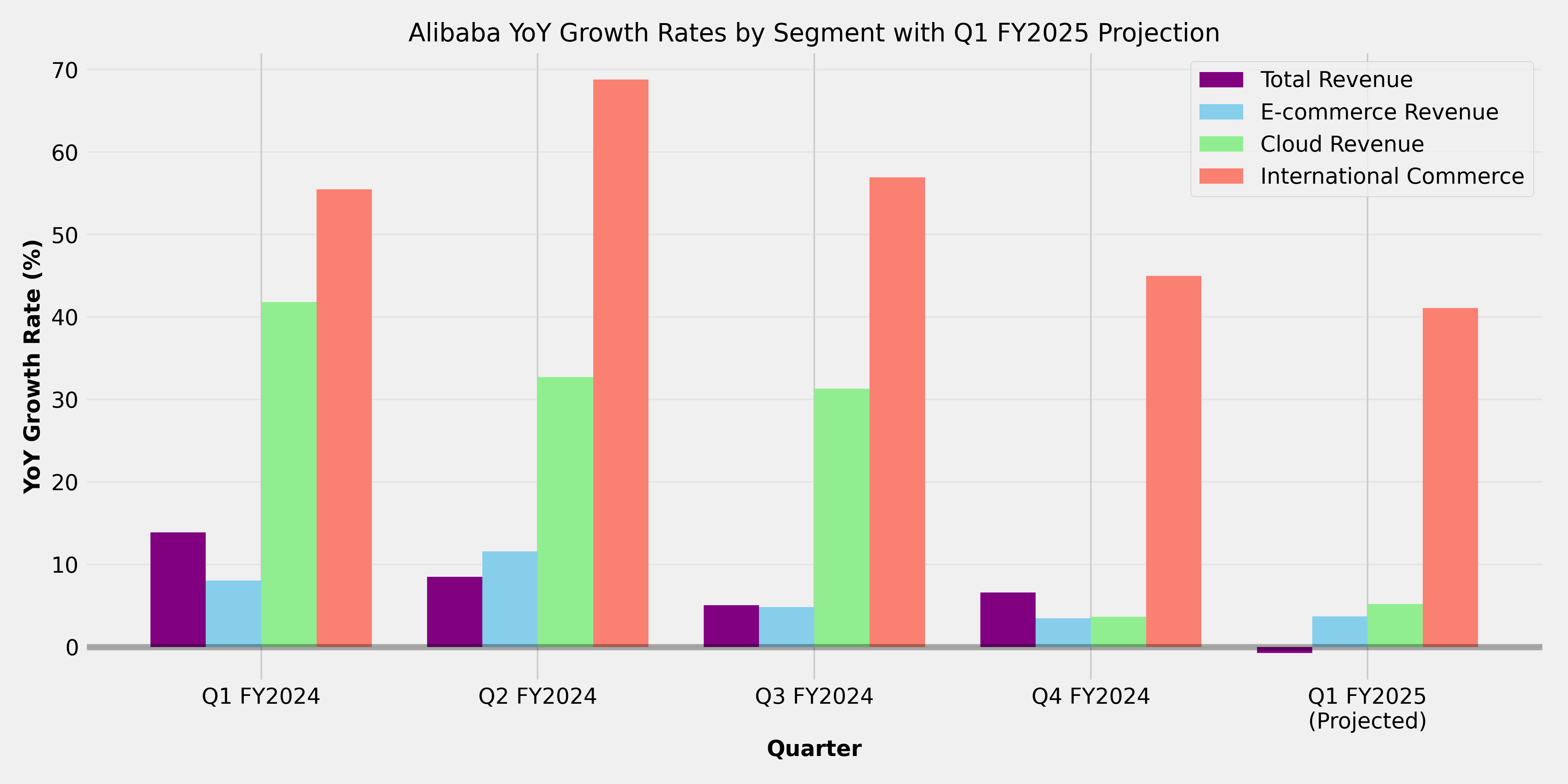

- Underwhelming Cloud Growth: With just 3% year-over-year growth, Alibaba's Cloud Intelligence Group significantly underperformed compared to global cloud competitors who are experiencing strong growth driven by AI adoption.

- Declining Profitability in Core E-commerce Business: The 1% year-over-year decline in adjusted EBITA for the Taobao and Tmall Group indicated pressure on profitability in Alibaba's core business.

- Significant Drop in Free Cash Flow: The 52% year-over-year decline in free cash flow raised concerns about Alibaba's ability to fund future growth initiatives and return capital to shareholders.

- Monetization Challenges: The company noted that its overall take rate decreased year-over-year, indicating challenges in monetizing its e-commerce platforms effectively.

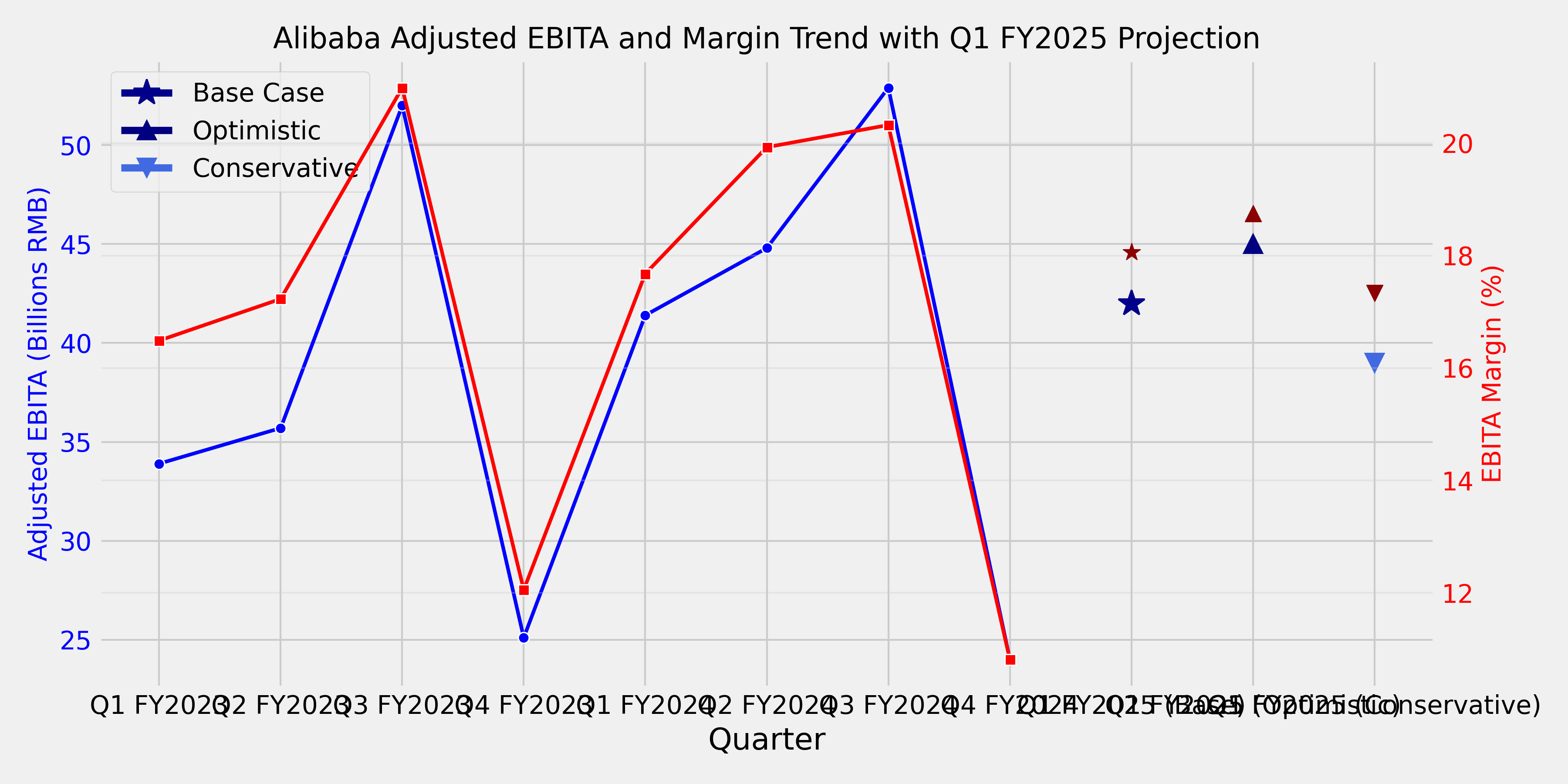

Fig 2: Alibaba's adjusted EBITA and margin trend with Q1 FY2025 projections

Segment Performance Analysis

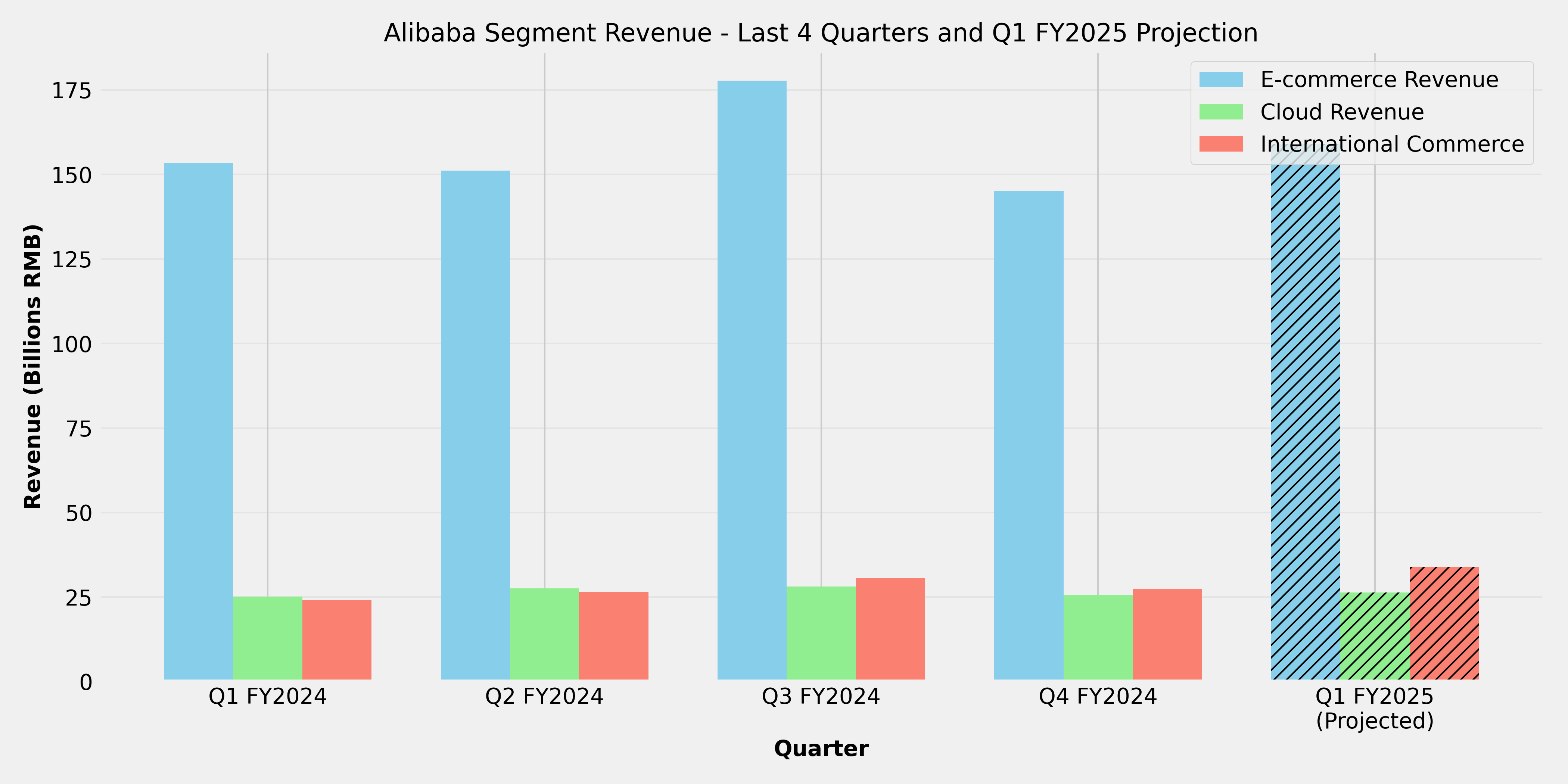

Fig 3: Alibaba's segment revenue breakdown for the last 4 quarters with Q1 FY2025 projection

Taobao and Tmall Group (China Commerce)

Revenue for this core segment reached RMB 93.22 billion (US$12.91 billion), a modest 4% increase year-over-year. Customer management revenue grew by 5%, primarily due to double-digit year-over-year growth in online GMV, excluding unpaid orders. However, this was partly offset by a decline in overall take rate. Direct sales and others revenue decreased by 2% year-over-year.

Adjusted EBITA for this segment was RMB 38.50 billion (US$5.33 billion), a 1% decrease compared to the same quarter last year. This decline was attributed to increased investments in user experience and technology infrastructure, which management believes will improve consumer retention and purchase frequency in the future.

Cloud Intelligence Group

Cloud revenue grew by just 3% year-over-year to RMB 25.60 billion (US$3.55 billion), which was significantly below market expectations. The company explained that this modest growth was mainly driven by Alibaba-consolidated businesses, while revenue excluding Alibaba-consolidated subsidiaries decreased slightly as they transition away from low-margin project-based revenues.

Despite the slow revenue growth, adjusted EBITA for this segment increased by 45% to RMB 1.43 billion (US$198 million), primarily due to improving product mix through focus on public cloud and operating efficiency. Management expects strong revenue growth in public cloud and AI-related products to offset the impact of the roll-off of project-based revenues in future quarters.

Alibaba International Digital Commerce Group

This segment showed strong growth with revenue increasing 45% year-over-year to RMB 27.45 billion (US$3.80 billion). International commerce retail business revenue grew by 56%, driven by solid combined order growth, revenue contribution from AliExpress' Choice, and improvements in monetization. However, this segment is still operating at a loss, with adjusted EBITA losses widening by 88% year-over-year.

Fig 4: Alibaba's year-over-year growth rates by segment with Q1 FY2025 projection

3-Month Projection (June-August 2024)

Based on current trends, management guidance, and market conditions, here's a projection for Alibaba's performance over the next three months (Q1 FY2025):

Base Case Scenario

- Revenue: RMB 232.5 billion (~5% YoY growth)

- Adjusted EBITA: RMB 42.0 billion

- Cloud Revenue: RMB 26.4 billion (~5% YoY growth)

- E-commerce Revenue: RMB 159.0 billion (~4% YoY growth)

- International Commerce: RMB 34.0 billion (~41% YoY growth)

Optimistic Scenario

- Revenue: RMB 240.0 billion (~8% YoY growth)

- Adjusted EBITA: RMB 45.0 billion

- Cloud Revenue: RMB 28.0 billion (~12% YoY growth)

- E-commerce Revenue: RMB 162.0 billion (~6% YoY growth)

- International Commerce: RMB 36.0 billion (~50% YoY growth)

Conservative Scenario

- Revenue: RMB 225.0 billion (~3% YoY growth)

- Adjusted EBITA: RMB 39.0 billion

- Cloud Revenue: RMB 25.0 billion (flat YoY)

- E-commerce Revenue: RMB 155.0 billion (~1% YoY growth)

- International Commerce: RMB 32.0 billion (~33% YoY growth)

Strategic Developments to Watch

- AI Integration: Acceleration of AI product deployment across cloud and e-commerce platforms

- International Expansion: Further growth in AliExpress Choice and other international initiatives

- Monetization Improvements: Potential new monetization strategies for e-commerce platforms

- Cost Control Measures: Possible implementation of additional efficiency initiatives

- Capital Allocation: Potential share repurchases to support stock price

Risk Factors

- Macroeconomic Conditions: Continued weakness in Chinese consumer spending

- Regulatory Environment: Potential new regulatory measures affecting tech companies

- Competitive Pressures: Intensifying competition from domestic and international players

- Investment Performance: Potential further mark-to-market losses from investment portfolio

- US-China Relations: Geopolitical tensions affecting business operations and investor sentiment

Conclusion

Alibaba's Q4 fiscal 2024 results revealed a company in transition, making significant investments for future growth while facing challenges in its core businesses and broader economic headwinds. The market's negative reaction reflected concerns about the pace of growth, declining profitability, and the effectiveness of the company's investment strategy.

Over the next three months, investors will be closely watching for signs that Alibaba's investments are beginning to yield returns, particularly in cloud computing and AI-related services. The company's ability to accelerate growth while improving profitability will be critical in rebuilding investor confidence. While Alibaba maintains strong market positions and significant financial resources, it faces an increasingly competitive landscape that will require effective execution of its strategic initiatives to deliver the growth and returns that investors expect.